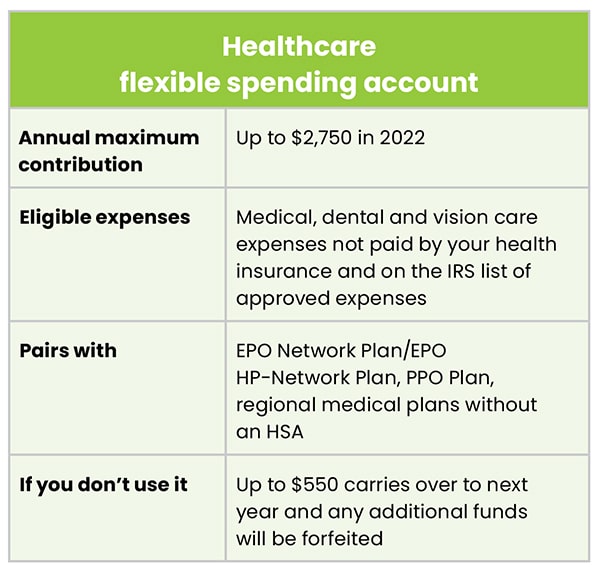

fsa health care contribution

This is a 200 increase from. The bottom line.

Hsa And Fsa University Of Colorado

Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850.

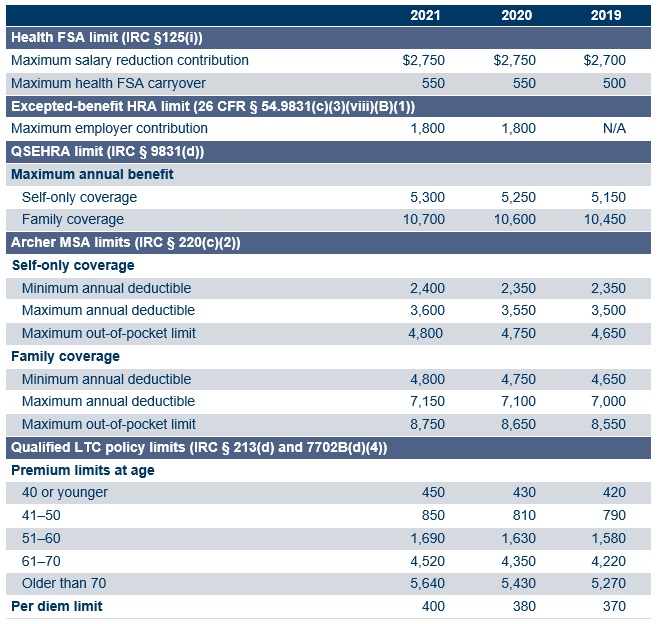

. 2023 IRS Limits for Healthcare and Dependent Care FSAs and Limited Purpose FSAs. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. How much should I put in my FSA 2021.

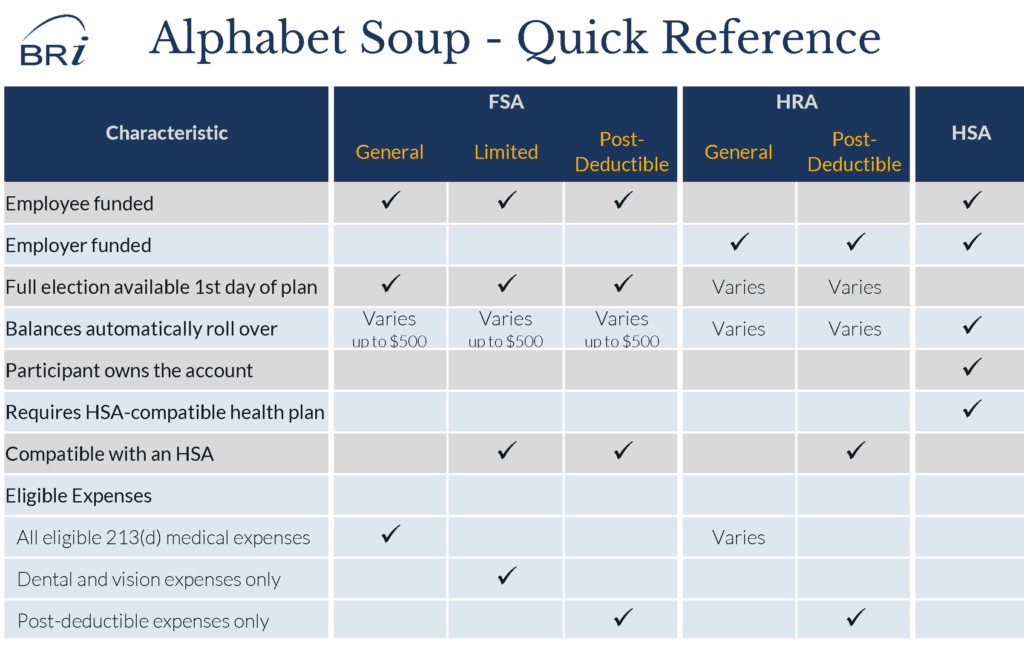

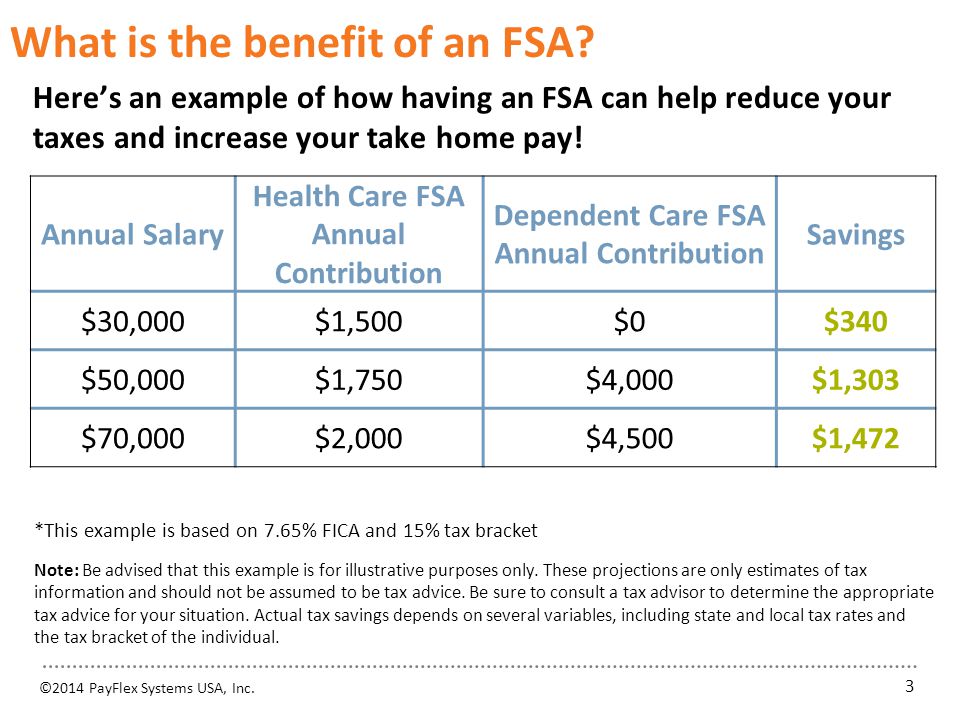

The health FSA contribution limit originally imposed by the Affordable Care Act ACA and set at 2500 adjusts in 50 increments based on a complex cost-of-living. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. Health FSAs let workers stash away pretax money for qualifying medical expenses.

For plan year 2022 the maximum contribution amount that. FSA CONTRIBUTION 0 31950 TAXABLE INCOME 35000 7189. The contributions you make to a flexible spending account FSA are not tax-deductible because the accounts are funded through salary deferrals.

The IRS has not yet. The higher contribution limits applied only to the plan year beginning after Dec. Health 9 days ago As a result the IRS has revised contribution limits for 2022.

The 2022 FSA contributions limit has been raised to. Basic Healthcare FSA Rules. Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the IRS.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. FSA contribution limits are adjusted annually for inflation. As a result the IRS has revised contribution limits for 2022.

The latest mandated FSA employee contribution limits on how much employees can contribute to these accounts is shown in the table below. HEALTH CARE FSA Full-service administration of consumer-driven and traditional account-based plans. Health Care Dependent Care Limited FSA until.

2022 Health FSA Contribution Cap Rises to 2850 Internal Revenue Service. For plan years beginning in 2023 the ACAs adjusted dollar limit on employees salary reduction contributions to health FSAs increases to 3050. Health Savings Accounts and.

FSA Annual Contribution Limits. For example if you earn 45000 per year and allocate 2500 to your FSA for health care. Unlike the Health Care FSA.

There are a few things to remember when it. For 2023 you can contribute as much as 3050 to your FSA up from 2850 in 2022. 31 2020 and before Jan.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. All Symptom Treatment Nutrition Fidelity Investments Health Reimbursement Account. A comprehensive list of 2023 IRS contribution limits for tax-advantaged employee benefits accounts such as HSAs FSAs HDHP 401k QSEHRA.

The Dependent Care annual FSA limit remains at 5000 2023 IRS Limits for Health. The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year. Health 4 days ago AdHelp.

Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the IRS. On October 18th in response to rising inflation the IRS announced that the healthcare FSA annual contribution limit will increase to 3050 from 2850 in 2023 adding. The health care Flexible Spending Amounts changed from 2850 to 3050 in maximum salary deferral contribution compared to last year.

10 as the annual contribution limit rises to. The 2022 FSA Contribution Limits are Here. Society for Human Resource Management SHRM.

Second your employers contributions wont count toward your annual FSA contribution limits. Listing Websites about Health Care Fsa Max Contribution. The limit for 2022 contributions is 2850 up from 2750 in 2021.

In the maximum carryover.

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Year End Health Care Fsa Reminders Hub

The Perfect Recipe Hra Fsa And Hsa Benefit Options

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

Fsa Rules 3 Tips For Easily Complying With The Irs Connectyourcare

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Health Care Fsa Contribution Limits Change For 2022

Employees Contribute To Pay Through Flexible Spending Accounts Fsa Mercer Us

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

Irs Releases Fsa Contribution Limits For 2021 Primepay

This Presentation Covers Ppt Download

The Health Care Flexible Spending Account Fsa Human Resources

Healthcare Flexible Spending Account My Aci Benefits

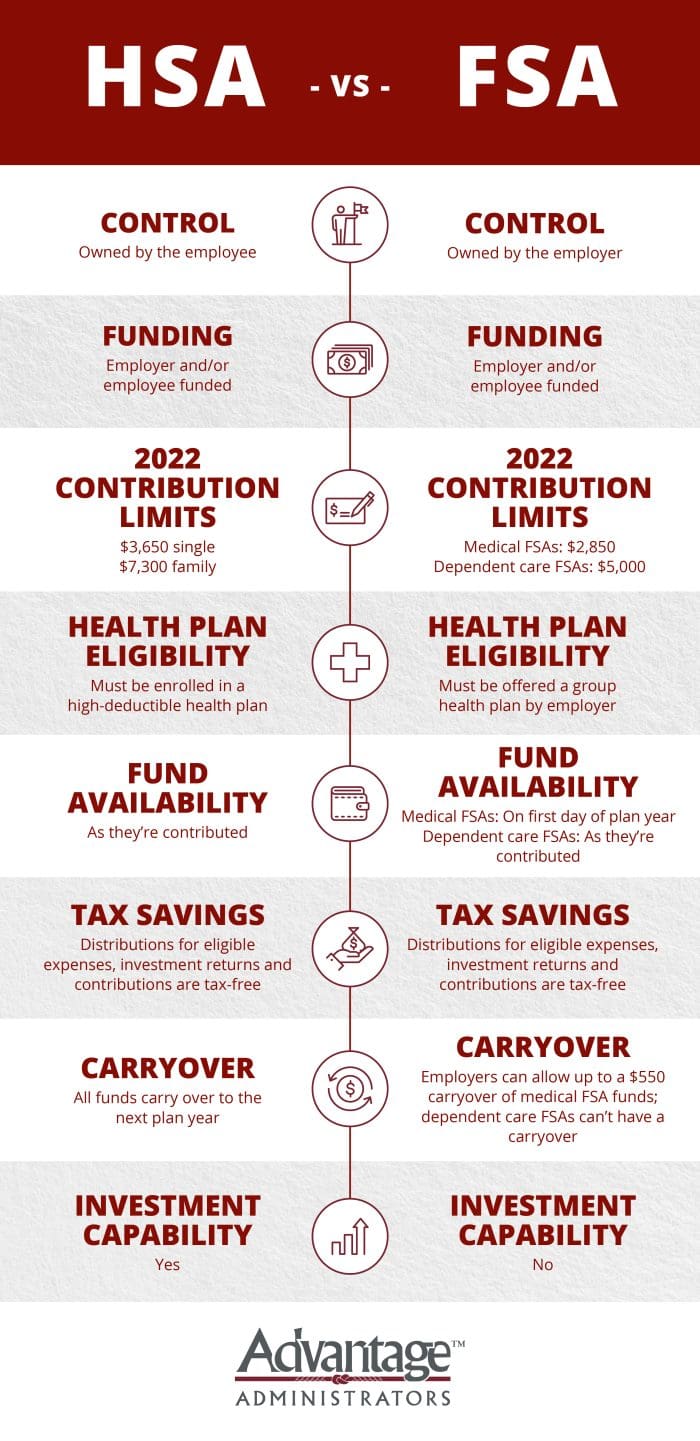

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Hsa Vs Fsa See How You Ll Save With Each Advantage Administrators